Key Points:

“Default rates on leveraged loans are rising sharply, signaling potential distress in the financial system.”,

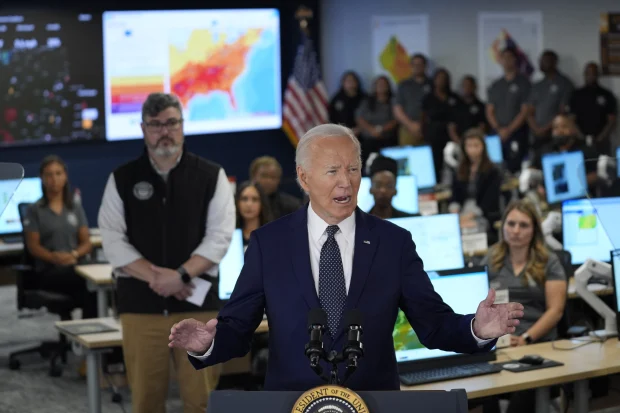

“The Bank of England (BoE) cautions that private equity’s opaque leveraged lending practices could pose risks to financial stability.”,

“Rising interest rates and economic uncertainty are increasing the pressure on companies with large debt burdens, making it harder to meet their loan obligations.”,

“The situation raises concerns about a potential domino effect, where defaults by one borrower could trigger a cascade of defaults across the financial system.”,

“Regulators are facing increasing pressure to scrutinize private equity’s lending practices and ensure adequate safeguards are in place.”

Content:

Defaults on leveraged loans are rising sharply, prompting the Bank of England to issue a warning about the potential risks posed by private equity’s lending practices. As interest rates rise and economic uncertainty grows, highly indebted companies are struggling to meet their loan obligations.

The situation is raising concerns about a potential cascade of defaults, which could spread through the financial system. Regulators are under pressure to increase scrutiny of private equity and the leveraged lending market to mitigate potential systemic risks.

Unique Perspective:

While leveraged loans have fueled a boom in private equity acquisitions in recent years, the current wave of defaults serves as a stark reminder that excessive debt can be a double-edged sword. This situation presents an opportunity for policymakers and regulators to re-evaluate the regulatory framework surrounding private equity and leveraged lending.

Striking a balance between fostering innovation and economic growth while ensuring financial stability will be crucial in navigating this evolving landscape. Furthermore, investors should prioritize due diligence and risk assessment when considering leveraged loans, recognizing that past performance is not always indicative of future returns.